2020 could be defined as the year Nigeria’s renewable energy market showed more grit and established that it is now a clockwork in the country’s electricity sector.

There were understandable doubts about the market’s ability to survive the impacts of COVID-19 when the pandemic broke but through steady and defining actions and progress, it survived with its weight felt.

This way, the market informed that it’ll be farfetched to snub it as a part of viable solutions to Nigeria’s electricity shortfall.

From providing electricity in locations where the national grid hasn’t reached yet, to supporting other places and facilities which are connected to the grid but hardly supplied reliable electricity, the market went to great extents in 2020 to show that it can be relied on. In 2021, it appears ready to pick up from where it left off to reinforce this.

When it mattered the most in 2020; when the COVID-19 pandemic beat up and smashed around, the RE market stayed up and firm to record amazing runs. It oriented itself to the demands of the time and leveraged bonds it has established with the society to support lives.

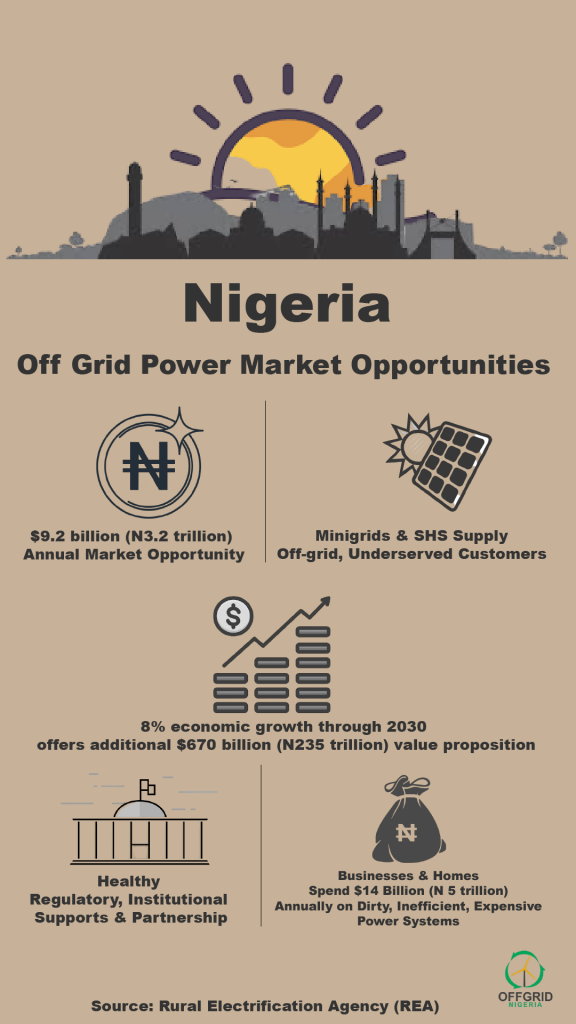

In many ways, renewables supported healthcare delivery to save lives from COVID-19. Through initiatives backed by the Rural Electrification Agency (REA), mini grids and solar-based solutions were set up to help keep healthcare facilities electrified for treatment of infected people. The REA more or less installed four solar hybrid mini-grids in four locations with high COVID-19 cases; the interventions powered ventilators, coolers and other critical medical equipment in these locations.

With hindsight, OGN reviewed and curated five key things that could happen next or support Nigeria’s renewable energy market in 2021:

Solar Power Naija – 5 million new solar connections

“The federal government already tasked us with the implementation of Solar Power Naija, a component of the Economic Sustainability Plan (ESP) designed to deliver 5 million new solar connections, serving 25 million Nigerians in rural areas and under-served urban cities,” Ahmed Salihjo – MD REA.

Based on Salihjo’s disclosure, Solar Power Naija could become REA’s big-ticket programme in 2021, and this will expectedly keep operators and the market busy.

The Central Bank of Nigeria (CBN) is backing the programme and has segmented participation across upstream – Manufacturers of solar components and Balance of System, and downstream – distributors and after-sales support solar home systems (SHS) operators and mini grid project developers, sectors of the market.

2nd call of REF

“As we round off delivery of all 12 mini-grids and 19, 000 SHS under the 1st Call of the Rural Electrification Fund (REF), the 2nd Call is underway with more mini-grids to be delivered. The Standalone Solar Home System (SHS) is proving to be a smart way to deliver energy for use in homes,” Ahmed Salihjo – MD REA.

Quite successful with its first Rural Electrification Fund (REF) call where circa N1.95 billion was awarded for mini grid development and deployment as well as solar home systems (SHS), the REA is equally expected to go on to the second call of the REF.

The second call will support the deployment of isolated and interconnected mini grids employing renewable energy or hybrid technologies, standalone SHS and grid extension projects. This is planned to accelerate access to electricity to rural and underserved parts of Nigeria. The scheme will cut through all Nigeria’s six geo-political zones.

Postscript: The REA is equally expected to kick off deployment of its Energizing Health Programme which is designed to energize 100 isolation centers and 400 primary health care (PHCs) facilities in the country in phases. Phase 2 of the Energizing Education Programme (EEP) is as well underway with beneficiary universities and teaching hospitals being audited.

Petrol subsidy

“Oil price volatility may undermine the viability of unconventional oil and gas resources as well [as] long-term contracts, providing a window of opportunity to reduce or redirect fossil fuel subsidies towards clean energy, while minimising the potential of social disruption,” Francesco La Camera, DG IRENA.

In industrialized nations, oil plays quite a negligible role in power generation but not in Nigeria. Because the country’s national grid isn’t trusted for reliable power, petrol and diesel generators are heavily relied on for alternative power. Nevertheless, this is an expensive power source which will get costlier in 2021 with the federal government’s removal of petrol subsidy.

For the last six years, the International Renewable Energy Association (IRENA) has indicated that renewables have become the dominant source of new power generation capacity because they are competitive at the bottom end of the conventional fossil fuel power generation cost range.

On the back of low oil prices and government’s elimination of petrol subsidy – which raises pump prices of petrol, OGN envisages a possible gain in attractiveness for renewables as viable options to fossil-powered generators. Outlandish pulls are not expected but increased awareness of the capabilities of renewables is likely. Operators could leverage this to net more users in 2021. Small business and residential homes are easy targets to consider.

Electricity tariff

“In compliance with the provisions of the Electric Power Sector Reform Act (EPRSA) and the nation’s tariff methodology for biannual minor review, the rates for service bands A, B, C, D and E have been adjusted by NGN2.00 to NGN4.00 per kWhr to reflect the partial impact of inflation and movement in foreign exchange rates,” NERC

Starting from November 1, 2020, Nigeria’s electricity regulator – the NERC, approved for Discos new pricelists for electricity supplied to consumers. The tariff is paid depending on the customer’s tariff class.

NERC explained that each tariff class has a unique rate applicable to it, and that in deciding, it considered influential economic indicators – exchange and inflation rates, as well as gas price and available power generation.

When it approved the tariff, it relied on 14.9% inflation rate, adopted the CBN exchange rate of N383.80/$ (NGN/USD) and 1.22% US Inflation rate often used for gas price as well as $2.5/MMBTU and US$0.80/MMBTU for gas price and transportation cost. The NERC also maintained the 4646 megawatts generation capacity.

NERC noted that the tariffs are service level configured and without financial subsidy from the federal government. This thus gives the Discos the cost-reflective tariffs they’ve requested for and will see increases in consumers’ power expenditures. With an unreliable grid, it is probable that consumers will in 2021 consider viable alternatives and solar is one of these.

Again, no outlandish shift is expected in consumers’ preferences, but consciousness on the availability and potentials of renewables is expected to grow. Programmes such as the Solar Naija amongst others could also drive this awareness and demand for solar power among rural SMEs or households.

High impact investments

“The Nigeria Off-Grid Energy Challenge is a joint effort by the U.S. African Development Foundation (USADF) and All On to provide angel stage funding for Nigerian businesses that are developing, scaling-up or extending the use of proven technologies for off-grid energy to reach communities not served by existing power grids,” USADF- All On

Having opened up itself for impact investments backed by multilateral organisations, OGN envisages the trend to resume in 2021.

In January, the United States Africa Development Foundation (USADF) and All On partnership announced its request for proposals for the Nigeria Off-Grid Energy Challenge, an annual funding and support scheme for renewable energy deployment.

Proposals of up to US$100,000 in 50/50 blended financing of grant, debt or equity per award will be considered in the challenge; 20 awards are equally projected. USADF and All On will consider proposals from 100% African-owned and majority Nigerian-owned and Nigerian-managed companies. The World Bank, African Development Bank (AfDB), Global Off-Grid Lighting Association (GOGLA), EU amongst others have ventured in the market and could continue in 2021.