Anyone able to endure Nigeria’s snags can earn good rewards from country’s off grid electricity market.

From existing market indicators, Nigeria’s off grid electricity market is promising and could be for a long time. Between 10 and 15 gigawatts of electricity is reportedly generated off grid through scall-scale generators in Nigeria – consider switching this with competitive clean energy solutions; 50 per cent of the country’s population is also with limited or no access to electricity from the national power grid.

Electricity generated off grid with mostly dirty fuel is more than the volume generated and put on the national grid which is averagely 4500 megawatts (MW) a day. When considered, existing market data from credible sources on this aptly put Nigeria as a big and attractive off grid electricity market destination in Africa.

Helped by its geographical location on the tropics, the good sunlight hours Nigeria enjoys also puts it as one of the best locations in the world for mini grids and solar home systems; the country reportedly has an annual average sunshine of about 6.25 hours, ranging from 3.5 hours in the coastal regions to 9 hours in the north.

It equally enjoys a mean daily solar radiation of about 5.25 kilowatt-hours per square meter per day (kWh/m2·day), ranging from 3.5kW/m2/day in coastal zones to 7.0kWh/m 2/day in the north.

Nigeria’s Gross Domestic Product (GDP) is reportedly the largest in Africa, at about $448.12 billion in 2019 – and still growing; it has over 180 million people, most of who don’t have access to electricity from its poorly performing grid while significant volumes of activities in the economy are powered by small-scale generators.

With such poor electricity supply, the country’s Rural Electrification Agency (REA) stated in a report that her businesses spend about $14 billion annually on inefficient electricity generation options which are expensive at $0.40 per kilowatt hour (kWh) or N140/kWh.

The REA also noted that the cost could be more, in addition to the poor-quality supply, noise and environmental pollution associated with such generation options and thus underlined the economic promises held by the sector.

Abundant Opportunities

According to the REA, developing off grid alternatives to complement supplies from the poor grid could create a $9.2 billion a year market opportunity for mini grids and solar home systems.

These solutions if deployed, could save $4.4 billion annually for Nigerian homes and businesses which have been underserved.

“There is a large potential for scaling – installing 10,000 mini grids of 100kW each can occur by 2023 and only meet 30 per cent of anticipated demand,” said the REA in a report, ‘the off-grid opportunity in Nigeria’.

The REA explained that getting off-grid solutions to scale and become commercially viable in Nigeria will unlock an enormous market opportunity, not just in Nigeria but across the continent’s countries with smaller demand and less-robust economies.

It indicated that a strategy, ‘the Off-Grid Electrification Strategy’ has been created to leverage the opportunity. The strategy is within the Power Sector Recovery Programme (PSRP) which Nigeria developed with the World Bank to revive its power sector.

Latent demands, strong willingness to switch

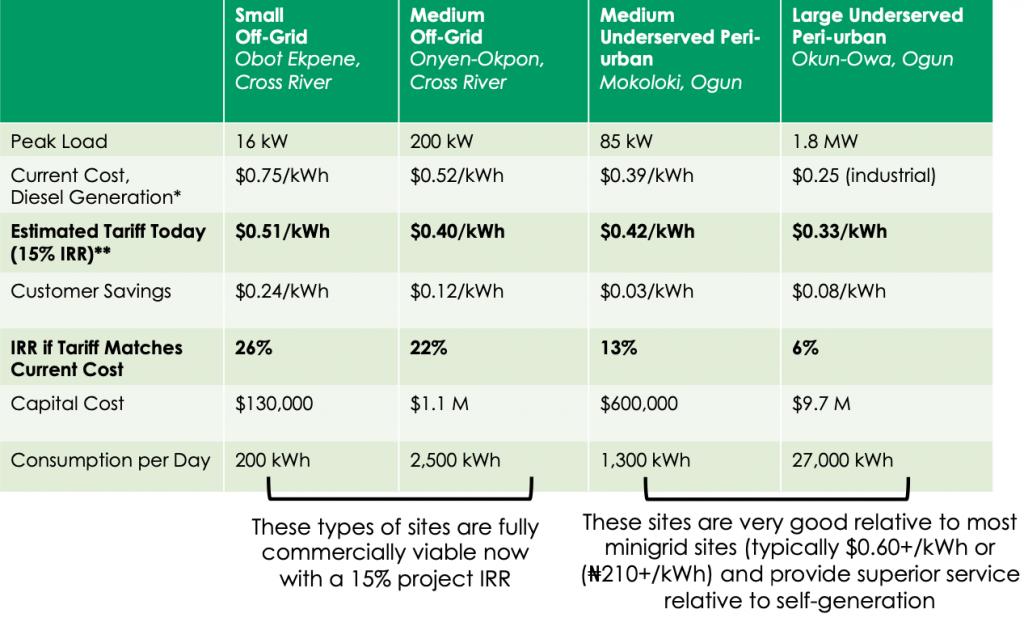

From its evaluation of specific sites, the REA explained that strong mini grid business opportunities existed across the country; it said there are thousands of high potential mini grid sites open for investment.

“Unlike many regions in Africa, Nigeria’s economy and strong entrepreneurialism mean that millions of commercially-viable businesses are powered with expensive and/or unreliable power.

“Consequently, there are high densities of power use, large latent demand, and a strong willingness to switch to more effective alternatives,” it stated.

The REA further stated that its recent efforts identified hundreds of high potential sites for investment and demonstrated potential for commercial viability.

It added that deep dive analyses in Ogun and Cross River states show numerous sites that are ready for large, medium, and small-scale mini grid investments.

REA surveys of 200 sites in 5 states provide quantitative evidence for mini grid opportunity

“For example, a medium-scale system (e.g., 200kW) can make commercial returns while covering its cost of capital, creating a return on investment of 3 years – this is a situation not currently found elsewhere in Sub-Saharan Africa.

“Many rural households spend more than $6/month (N2,100/month) on kerosene or battery powered torches, making a compelling case for solar home systems,” the REA highlighted.

A supportive environment opens up

To fully leverage the opportunities, Nigeria has further set up an eco-system of support to would-be operators and investors staring with the mini grid regulation enacted by the Nigerian Electricity Regulatory Commission (NERC) to provide regulatory protection for new investments.

The country has equally recruited the World Bank to provide funding supports as well as technical supports and corporate governance practices in potential investments.

Largely, the country’s newly built eco-system of support for the off-grid market comprises the government, donor partners, and private sector actively working together to create enabling conditions for the market to transition.

“Nigeria is providing an enabling environment for off-grid market growth, including, developer protection through the NERC mini grid regulations. An innovative and best practice site-selection process to de-risk projects has already identified over 200 promising sites.

“The selection process has also [been] screened for baseload demand (e.g., schools), population/energy density and productive use. Partnering with World Bank to line up finance, streamline competitive tendering, and to provide technical assistance,” said the REA which added that the private sector participation is considered the essential to the market’s development.

With an enabling environment, continued cost reductions, and targeted finance, the REA stated that Nigeria’s mini grid electricity market could rapidly scale to over 10,000 sites by 2023, powering 14 per cent of the country’s population with capacity hitting 3,000 MW.

This, it noted will also create an investment potential of nearly $20 billion or N7 trillion, and annual revenue opportunity exceeding $3 billion or N1 trillion to investors.

Willingness to pay

In context, the REA explained that in Onyen-okpon community in southern Cross River state, poor quality electricity costs community folks as much as $0.52/kwh or N180/kwh) despite large productive loads.

Situated 7 kilometres (km) from existing electricity grid, Onyen-okpon’s 500 households rely on electricity from 100kW existing self-generation systems which are often unreliable and affordable.

300 households of the community, it said have a load demand of 60kW, while demand for commercial or productive uses is put at 170kW.

With majority of its residents currently paying $0.43/kWh (N150/kWh) for petrol generation or $0.52/kWh (N180/kWh) for diesel, resulting to unelectrified households spending an average of $6 per month for kerosene and extra expenses on rechargeable torches, candles and cell phone charging, its community leaders and residents showed their willingness to pay for economically competitive alternatives which mini grids offer.