*Shuts out imported wires, switches in new solar power loan

Nigeria’s central bank, the CBN, is targeting to save the country up to $10 million annually by substituting imported solar power components used in the country’s renewable energy sector with locally manufactured alternatives.

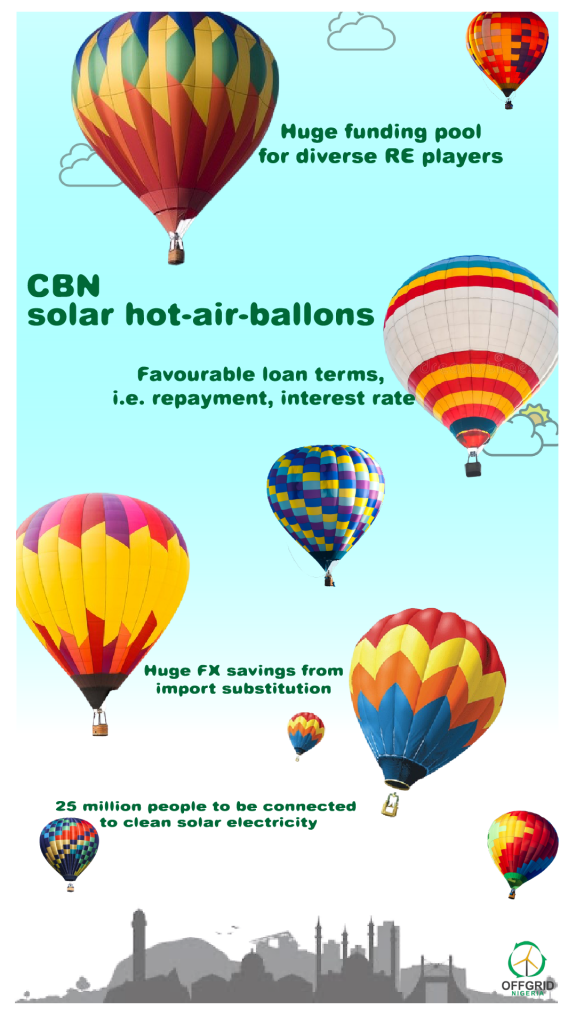

The CBN in a guideline it published on how it will administer a new financial facility in support of the fledging industry, said it wants solar power operators in the country to locally source for most of the components they will use to build and connect 25 million unelectrified people to clean solar electricity.

For this reason, it said that it will not fund projects with mostly imported solar balance of system (BOS) components in the new financial facility. BOS encompasses all components of a photovoltaic system other than the photovoltaic panels, and includes wiring, switches, mounting system, inverters, battery bank and chargers.

Solar equipment manufacturers, mini grid developers and solar home system providers in Nigeria are qualified to benefit from the facility with terms comprising five to 10-year tenor, two-year moratorium and nine to 10 per cent interest rate per annum.

The CBN explained that it expects that its facility will yield a tax return worth N7 billion annually to Nigeria as well as savings worth $10 million in import substitution.

In the guideline for the facility, the apex bank explained that the ‘Solar Connection Intervention Facility’ will complement the federal government’s effort to provide affordable electricity to rural dwellers through long term low interest credit facilities.

The facilities it added will be provided to prequalified participants in the Nigeria Electrification Project (NEP) which is managed by the Rural Electrification Agency (REA). Manufacturers and assemblers of solar components as well as off-grid energy retailers in the country are parts of this value-chain and could benefit.

Reasons for the facility

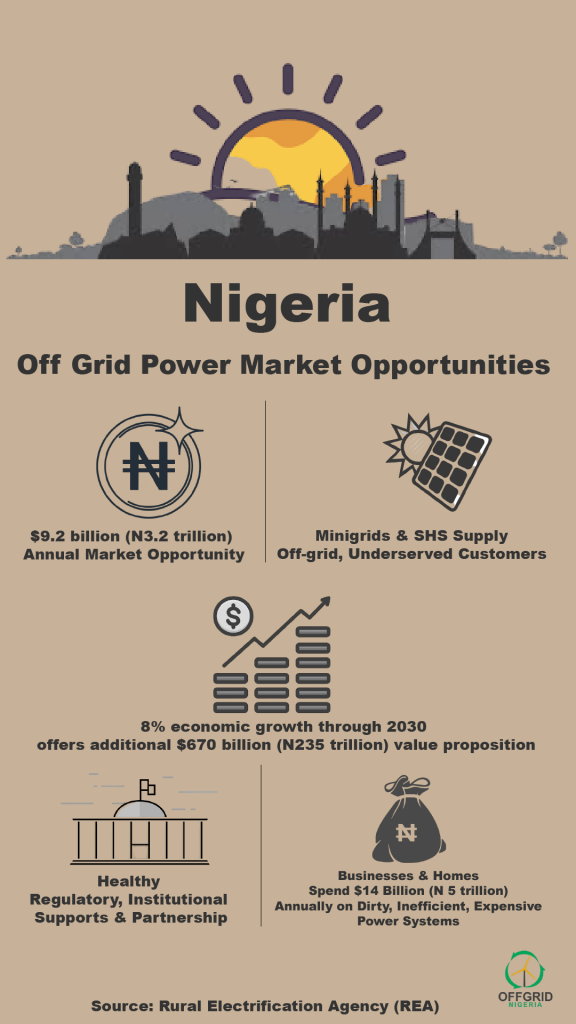

According to it, the facility was initiated to bridge energy access gap in the country. It noted that the pathways to energy access, financial inclusion and poverty reduction are closely linked and thus requires rapid scale of pay-as-you-go (PAYG) off-grid technologies which will create a $2 billion annual market opportunity in the country.

The CBN also stated that as part of Nigeria’s economic recovery from the COVID-19 pandemic, the government launched an initiative to roll out five million new solar-based connections in communities that are not connected to the grid; the facility, it said will support this.

“This program is expected to generate an additional N7 billion increase in tax revenues per annum and $10 million in annual import substitution,” the bank said.

It also added that: “The solar connection scheme is a federal government initiative whose objectives are to expanding energy access to 25 million individuals through the provision of solar home systems (SHS) or connection to a mini grid, increasing local content in the off-grid solar value chain and facilitating the growth of the local manufacturing industry.”

How to benefit, and who could benefit

According to the CBN, two distinct groups – manufacturers and service providers, will be eligible to tap into the facility.

For the manufacturers’ group, it indicated that manufacturers of solar components and balance of system could leverage the facility to set up, expand or upgrade their manufacturing facilities.

It however stated that importation of fully assembled solar components and BOS will not be financed by the facility.

Additionally, it said that, “eligible manufacturers must demonstrate a track record of experience in manufacturing of key off-grid components up to the quality standards instituted by the Rural Electrification Agency (REA) and/or Standards Organizations of Nigeria (SON).”

The manufacturers, it added must equally show capacity to repay the loan through a sufficient debt service current ratio, while being wholly Nigerian-owned or with a minimum of 70 per cent local ownership.

This group, it explained will also be allowed to access up to 70 per cent of the total cost of the project they intend to execute, with up to 10 years repayment timeline and nine per cent per interest rate per annum.

However, it explained that, “as part of the Bank’s Covid-19 relief package, the interest rate to be charged up to 28th February 2021 shall not exceed five per cent per annum.”

For the second group of beneficiaries which include service providers involved in the distribution and after-sales support of solar home systems (SHS), mini grid project development and other retail-based off-grid solar power providers, the bank noted that it will not fund the sales or deployment of fully imported solar home systems components with no proof of existing local content or credible plan for near-term integration of local content.

It also said mini grid projects that are to be built with fully imported components solar PV and BOS with no proof of existing local content will also be denied funding from the facility.

Mini grid projects in this group will equally get funding up to 70 per cent of project cost, with repayment timeline being seven years. The loan will also attract a 10 per cent interest rate per annum.

The bank stated that periodic joint monitoring and evaluation of financed projects will be done by it and the REA, with penalties meted to beneficiaries who divert funds, found guilty of non-rendition of returns or the rendition of false returns, default in loan repayment and illegally withdraw from revenue collection account.