By Chibuikem Agbaegbu* and Ifeoma Malo*

Nigeria’s Energy Predicament

A 2018 World Bank Data puts Nigeria’s un-electrified population at 75 million people – and this number of energy poor poses one of the greatest energy access challenges globally. With decades of billion dollar investments on the grid failing to deliver the required improvements in the electricity sector, the country’s off-grid population has been steadily on the increase – concurrent with the country’s annual population growth.

In recent years, decentralized renewable energy (DRE) has emerged as a faster and more affordable alternative in driving energy access to Africa and particularly Nigeria’s off-grid population especially in rural areas. While the International Energy Agency (IEA) expects the highest electrification rate over the next decade to be achieved by East Africa, Nigeria is expected to connect the largest number of people. From basic lighting solutions to large mini-grids, the off-grid market in Africa and Nigeria has recorded significant growth in recent years with Nigeria’s off-grid market for mini-grids and solar home systems estimated to yield USD 10 billion annually in revenue and savings of USD 6 billion for Nigerian homes and businesses.

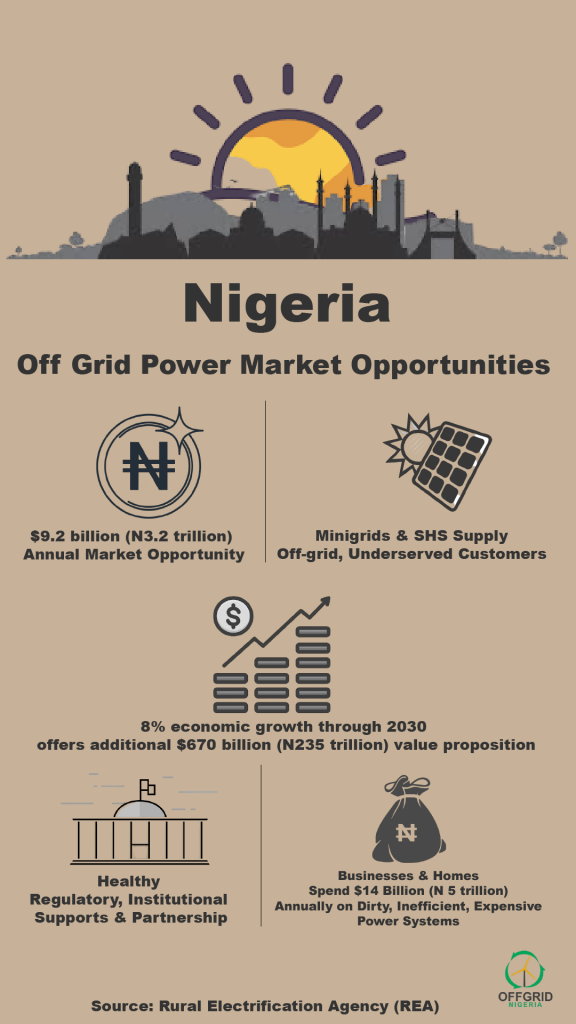

Nigeria’s Off-Grid Market Potentials

According to the Global Off-Grid Lighting Association (GOGLA), Nigeria has the second largest potential off-grid market in the world after India with 8 percent of the global off-grid household population of 434 million households. The country’s Rural Electrification Agency (REA) plans to deploy 10,000 mini-grids across the country and yet estimates that installing 100kWh each per mini-grid will only meet 30 percent of anticipated demand in the country.

Despite its for-profit nature, Nigeria’s off-grid financing market is characterized by philanthropic interests; with many private enterprise players but a slow uptick of investors. This can be attributed to various factors including the need for a stronger policy and fiscal framework to incentivize the sector, but also the high risk perception of the market resulting from the lack of a robust payment collection system for off-grid consumers which constitute a huge bulk of the off-grid population.

The absence of a Mobile Network Operator (MNO)-driven mobile money platform, currently the only widely available potential payment solution for off-grid customers has stalled investments in the sector as off-grid companies, investors and potential financiers have to be guaranteed of a reliable payment system for their return on investment.

Need for Mobile Money

Currently off-grid energy solutions are characterized by high capital costs and require affordable consumer payment solutions through a secure and widespread payment platform that can reach their potential consumers in remote rural communities and mobile provides this platform at the scale required. The challenge even in grid-connected communities with residents having to make long trips to make payments for electricity that is more absent than present in their communities, is even more significant for off-grid communities and a major obstacle in providing energy access to these communities.

Mobile phone penetration in Nigeria is one of the fastest growing in the world currently at 84 percent penetration with 162 million mobile subscriptions from 53 percent in 2016. This is driven by the availability of low cost phones with more Nigerians especially those in remote communities now owning a mobile device. This presents a huge opportunity for the off-grid energy market as a potential secure payment platform for remote areas where financial services are absent as long as there is access to a mobile operator network.

Nigeria has limited mobile money penetration (about 1 percent of mobile subscribers); due to the Central Bank of Nigeria’s (CBN) regulation which limits MNO-driven mobile money provision. However as shown with the growth of the off-grid energy market in other countries especially in East Africa and slowly in other West African countries, mobile money is a key enabler in unlocking the required investment in off-grid energy access for the millions of Nigerians living without energy access with little hope of having the grid extended to them in the foreseeable future. Even when extended, these communities are saddled with unreliable and epileptic power supply.

Case Studies from East African Countries

In East Africa, up to 800,000 solar home systems are available on a pay-as-you-go (PAYG) basis with 40,000 new systems deployed monthly, proving the technology, business model, high demand and ability for low income customers to pay for clean energy through mobile money. It has also enabled the off-grid energy sector to attract exceptional amount of funding. Over USD 360 million was invested between 2013 and 2016 in PAYG solar ventures, and more recently the World Bank is providing about USD 350 million for off-grid rural electrification in Nigeria.

Kenya’s off-grid energy market, arguably the fastest growing in Africa, has provided energy access to over 500,000 households, boosted through its robust mobile money service which enables PAYG consumer financing; making off-grid energy affordable and available to very remote communities. In October 2017, M-Kopa Solar, one of Kenya’s leading off-grid energy companies accessed USD 80 million commercial finance backed by consumer receivables enabled through mobile money payments, and currently the largest debt financing in the PAYG sector. The potential of unlocking multiples of such financing for the Nigerian off-grid market is huge with mobile money.

Enabling MNO-driven mobile money will be a catalyst in driving energy access across the country and enabling the government meet its electricity access target. Financiers and off-grid companies need to be assured of an easy payment system with all the features that mobile money provides particularly in terms of reach and security of payments. This is in addition to other benefits mobile money payments provide such as servicing the unbanked rural consumers’; as well as providing formal financial services for off-grid companies.

Mobile money payment also allows banks to assess and segment customers according to payment risk, credit extension in the form of a high-value electricity asset that is paid off over time, incentives to drive payment behavior, follow up on non-payment, creation of a formal credit history for customers which is important for financial inclusion, and facilitating digital financial literacy. Other key benefits include the attraction of patient capital required for the industry, enabling productive use of electricity for socio-economic development in communities, risk reduction associated with cash collection through agents through digitally-financed energy, and financial inclusion to the unbanked in these communities.

What CBN should do

In 2012, the CBN launched a cashless policy to curb excesses in the handling of cash as well as insisting that mobile money operations be bank-led due to the perceived threat to retail banking in Nigeria if extended to MNOs. However banks have limited mobile money to just mobile banking as an add-on service to already existing customers with lesser focus on financial inclusion for the unbanked population particularly in rural areas. This limits the provision of payment-related services to these areas.

The CBN should permit MNO-driven mobile money solutions by granting mobile money licenses to MNOs and regulated by the CBN through a strong mobile money regulatory framework. Under the MNO-driven model, the MNO provides electricity payment services as a value-added service under its mobile money license, enabling subscribers to make payments for electricity in the form of electronic money which are settled through the MNO’s established agent network.

A clear distinction from the bank-led model is that the subscribers do not need to have a bank account. The electricity ‘payment-in-transfer’ in principle could be a deposit held in an account with a bank, as such the MNO serves to execute and facilitate electricity payments without performing the basic roles of a bank. Payments are maintained in a trust account in a bank and cannot be used by the MNO as funds for its business. This ensures the MNO acts purely as a payment facilitator and not carrying out the roles of a bank. This will be effective for organizing such informal electricity payments into a formal financial system required by off-grid companies, and expanding energy access to communities.

The CBN can also explore a hybrid model – combination of the bank and MNO model – in the context of perceived competition between banks and MNOS. Through this model, banks and MNOs work together in extending mobile money transfer and mobile banking services to off-grid customers. The MNO’s mobile money service handles the electricity payments with cash in/out through its agent network, which is linked to formal banking services such as savings, credit extension, insurance and bank account extension to the MNO’s subscribers.

This will provide a win-win for all parties – the off-grid company easily gets payments for its electricity service; it serves the MNO’s objectives in facilitating digital payments, churn reduction, customer acquisition and increased average revenue per user. It also serves the bank in terms of outreach, customer acquisition, and cost reduction. Various banks are already providing mobile operator USSD codes as services to their customers for money transfer, bills payments, and even for opening bank accounts.

In Conclusion:

The CBN should see the extension of mobile money services to MNOs not as a threat to retail banking for commercial banks but as a win in the provision of services such as electricity and financial inclusion for the millions of unbanked Nigerians. According to InterMedia’s Financial Inclusion Insights, Nigeria’s financial inclusion was just 30 percent in 2017 and mobile money presents a huge opportunity in driving the attainment of the CBN’s vision of 80 percent financial inclusion by 2020 as stipulated in its National Financial Inclusion Strategy.

By enabling energy access to off-grid communities and encouraging digital transactions, the CBN will be facilitating economic development to the thousands of off-grid communities across the country. With electricity access comes socio-economic development, improved standard of living, and increased income outcomes, job creation through productive uses of electricity, and various other energy dividends.

*Mr. Chibuikem Agbaegbu is Nigerian Lead – Market Access – Power For All

* Ms. Ifeoma Malo is Nigerian Country Director – Power For All